Request to Lower an Income Related Monthly Adjustment 2022

What makes the request to lower an income related monthly adjustment form legally binding?

Because the society takes a step away from office work, the completion of paperwork increasingly occurs electronically. The request to lower an income related monthly adjustment form isn’t an exception. Handling it using electronic tools differs from doing this in the physical world.

An eDocument can be regarded as legally binding provided that particular requirements are met. They are especially crucial when it comes to stipulations and signatures related to them. Typing in your initials or full name alone will not ensure that the institution requesting the form or a court would consider it performed. You need a trustworthy tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your request to lower an income related monthly adjustment form when filling out it online?

Compliance with eSignature laws is only a portion of what airSlate SignNow can offer to make form execution legal and safe. It also gives a lot of possibilities for smooth completion security wise. Let's quickly go through them so that you can stay certain that your request to lower an income related monthly adjustment form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy standards in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties identities through additional means, like an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the data securely to the servers.

Submitting the request to lower an income related monthly adjustment form with airSlate SignNow will give greater confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete request to lower an income related monthly adjustment

Effortlessly Prepare Request To Lower An Income Related Monthly Adjustment on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Request To Lower An Income Related Monthly Adjustment on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign Request To Lower An Income Related Monthly Adjustment with Ease

- Locate Request To Lower An Income Related Monthly Adjustment and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Request To Lower An Income Related Monthly Adjustment to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct request to lower an income related monthly adjustment

Create this form in 5 minutes!

How to create an eSignature for the request to lower an income related monthly adjustment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I appeal Irmaa in Medicare 2023?

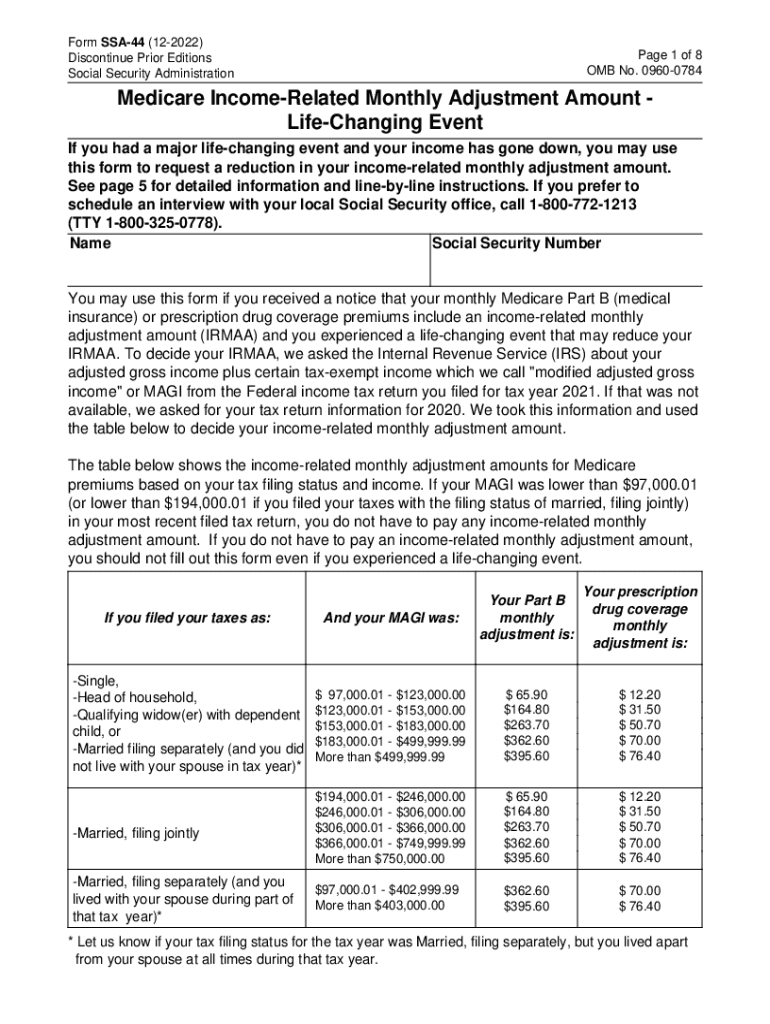

How to appeal IRMAA? Medicare requires you to complete a specific form to request a review of your IRMAA fee. You can appeal these by completing the Social Security Administration form SSA-44.

-

What is irmaa for 2023?

Medicare Part B IRMAA In 2023, the standard Part B monthly premium is $164.90. Medicare recipients with 2021 incomes exceeding $97,000 (single filers) or $194,000 (married filing jointly) will pay a premium between $230.80 and $560.50.

-

How can I reduce Irmaa?

The best way to reduce IRMAA (or avoid it) is to lower your Modified Adjusted Gross Income (MAGI).

-

What is the income-related monthly adjustment?

The Medicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount you may pay in addition to your Part B or Part D premium if your income is above a certain level. The Social Security Administration (SSA) sets four income brackets that determine your (or you and your spouse's) IRMAA.

-

Is Irmaa calculated every year?

IRMAA is calculated every year. That means if your income is higher or lower year after year, your IRMAA status can change. If the SSA determines you must pay an IRMAA, you'll receive a notice with the new premium amount and the reason for their determination.

-

What is the Irma limit?

People who earn over $97,000 and couples who make over $194,000 have to pay an extra fee called an income-related monthly adjustment amount (IRMAA) on top of their Medicare Part B and Part D premiums. The surcharge works on a sliding scale, and it applies to both Original Medicare and Medicare Advantage plans.

-

How often is Irmaa adjusted?

IRMAA is calculated every year. That means if your income is higher or lower year after year, your IRMAA status can change. If the SSA determines you must pay an IRMAA, you'll receive a notice with the new premium amount and the reason for their determination.

-

How do I request to lower an income related monthly adjustment amount?

Call +1 800-772-1213 and tell the representative you want to lower your Medicare Income-Related Monthly Adjustment Amount (IRMAA) if you had an amended income tax return.

Get more for Request To Lower An Income Related Monthly Adjustment

- Myfloridacom power of attorney form

- Blue cross blue shield next of kin affidavit form

- A will worksheet fort meade ftmeade army form

- Application for employment form es5jp gov uk

- Vermont registration form

- Arbeitsvertrag fr poliere und werkmeister baumeister form

- Post masters clinical experience form mass gov mass

- Newborn photography contract template form

Find out other Request To Lower An Income Related Monthly Adjustment

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile